Your Complete Guide to Singapore Tax Identification Number (TIN) in 2025

A Singapore Tax Identification Number (TIN) is a nine or ten-digit number assigned to citizens and businesses by the Inland Revenue Authority of Singapore (IRAS) for taxation purposes. The TIN is unique to each taxpayer and is used for filing taxes, registering for tax schemes, and other government transactions.

This article will cover everything you need about Singapore Tax Identification Numbers for private individuals and companies.

What is a Tax Identification Number in Singapore?

Think of the TIN as a government fingerprint of sorts.

It is a unique identifier for business entities and private individuals - a set of nine or ten-digit numbers, which the IRAS uses to keep track of tax-related information. The TIN is also used as an identification number when filing taxes or registering for specific government schemes.

You will come across two terminologies when referring to TIN in Singapore: Tax Reference Number (TRN) and Unique Entity Number (UEN). Here is a quick guide on the difference between the two:

Tax Reference Number (TRN): Assigned to Singapore Citizens and Permanent Residents by the Inland Revenue Authority of Singapore (IRAS)

Unique Entity Number (UEN): Issued to businesses by the Accounting and Corporate Regulatory Authority of Singapore (ACRA)

Before January 2009, businesses used Tax Identification Number (TIN) for tax filing purposes. They later reverted to UEN after the government changed their policies.

Why Are Tax Reference Numbers and Unique Entity Numbers Important for Tax Filing?

Individuals and companies in Singapore use the Tax Reference Number and Unique Entity Number, respectively, for all tax-related things.

But apart from tax-related transactions and procedures, both Tax Reference Number and Unique Entity Number can be used for other purposes. For example, the UEN can be used by businesses for the following activities:

Remittance of CPF payments

Application for export and import permits

Update company information on ACRA's BizFile system

And more...

Singapore Citizens and Permanent Residents, on the other hand, can use the Tax Reference Number or TRN for other purposes such as:

Applying for loans and credit cards

Fulfilment of employment requirements

Transactions with other government agencies

How Do Businesses in Singapore Use the UEN?

As we discussed earlier, businesses in Singapore weren't always using the Unique Entity Number assigned to them by ACRA. Before January 2009, companies were given unique Tax Identification Numbers (TIN) for tax-related purposes. Their government policies changed shortly after, and businesses started using UEN for all government transactions instead of the TIN.

But not all business entities are required to get a UEN. The following are not required to have a UEN:

Organizations with no transactions, or just one transaction, with the government

Branch offices, sub-entities, or divisions of a business or organization

Do you need urgent assistance with tax filing or do you have any concerns with anything related to taxation and/or accounting?

Fill up the form below to get in touch with one of our dedicated account specialists.

We will be in touch within one business day.

Where Can Newly Incorporated Companies Get Their Tax Identification Number?

Depending on what type of company you incorporated, there are different government agencies where you can get your Unique Entity Number, which is the equivalent of your Tax Identification Number.

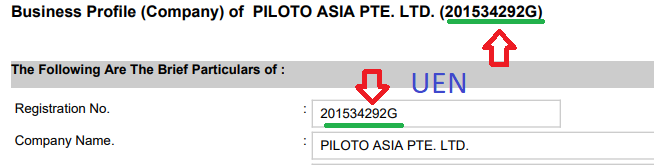

Are UEN and ACRA Registration Numbers the Same?

Yes, local companies and foreign companies incorporated with ACRA years ago were issued with ACRA Registration Number, which is now known as the UEN. In the screenshot below, this is where you'll find your UEN from your Company Incorporation Certificate:

Are UEN and GST Numbers the Same?

Local companies and other ACRA incorporated businesses will use their UEN as their Goods and Services Tax (GST) Registration Number. But foreign companies and partnerships will be issued a different GST registration number.

You can read more about Goods and Services Tax Registration here.

Who Can Get a UEN?

UEN is issued to local and foreign entities, from businesses, LLPs, and representatives to societies. Any entity that requires multiple transactions with the Singapore government is given a UEN.

UENs are not issued to entities with no, or only one-of, interactions with the government agencies.

How Do You Apply for Tax Reference Number in Singapore?

For Singapore Citizens and Permanent Residents, they can apply for a Tax Reference Number or TRN by doing the following:

Register for an account at IRAS or sign up through the SingPass website

Submit your National Registration Identity Card (NRIC) if you're a Citizen or Foreign Identification Number if you're a foreigner.

IRAS will review your application and send your Tax Reference Number within five business days.

How Do You Apply for Unique Entity Number in Singapore?

For local and foreign companies, societies, and trade unions, they'll have to obtain their UEN through the following agencies:

Accounting and Corporate Regulatory Authority issues UENs for local and foreign companies

Ministry of Culture, Community, and Youth gives UENs to non-profit organizations or charities

Ministry of Manpower (MOM) gives UENs to trade unions

The Registry of Societies issues UENs to registered societies

How Do You Pay Personal Income Taxes in Singapore?

Singapore Citizens and Permanent Residents and local and foreign businesses can pay their taxes through the IRAS website. Filing of tax returns is done yearly and must be submitted on or before April 15th of every year.

You don't need to pay taxes if your annual income is less than S$22,000 (this is only applicable for tax residents). But you still need to file tax returns if you were informed previously by the tax authority to submit a tax form. This is because even if you didn't earn any income for the previous year, you need to declare zero revenue in the tax form and submit it by April 15th for paper submissions or April 18th for e-filing. You will be subject to penalties for late filing or not filing. IRAS might also take legal actions against the individual for non-filing of tax return or non-payment of the tax.

You can read more about the following tax resources by clicking on the links:

The Wrap Up

There you have it. Everything there is to know about the Singapore Tax Identification Number. This is the Unique Entity Number (UEN) issued by ACRA for local and foreign companies. For individuals, this is the Tax Reference Number.

The Singapore Tax Identification Number is necessary for filing income tax returns, as well as transacting with other government agencies.

Frequently Asked Questions

-

For a foreign holding company operating in Singapore, the Unique Entity Number (UEN) is a crucial identifier. It is a 10-digit alphanumeric number issued by the Accounting and Corporate Regulatory Authority (ACRA) and serves as the primary tax identification number for all registered entities. The UEN is essential for various business activities, including filing taxes, opening bank accounts, and applying for government permits. To obtain a UEN, a foreign holding company must register with ACRA, a process that is typically completed online within a few days. Once acquired, the UEN is used for all tax-related transactions and compliance with the Inland Revenue Authority of Singapore (IRAS). Understanding and acquiring a UEN is vital for foreign holding companies to facilitate their legal and financial activities in Singapore.