2025 Ultimate Guide: Car Ownership in Singapore

Singapore does not shy away from the fact that it’s one of the best countries to live in right now. In an effort to motivate people to adopt an environment-friendly lifestyle within the country, the government has made it difficult to own an automobile by presenting aspiring purchasers with various government fees and other costs.

That’s why it comes as no surprise that Singapore has earned the reputation for being one of the most expensive countries to own a car in.

This article will go over the entire process of owning a car and the costs associated with owning one.

Author note: OMV is based on average pricing listed on car dealership websites in Singapore as of the latest changes (Jan 2023). Certain examples were used for computations carried out in this article and should only be used for gauging estimates.

Initial Costs Of Owning A Car

The first part we have to consider in owning a car in Singapore is the cost. To compute for how much it will cost you to own a car, we’re going to cover the following:

Cost Of Car

Interest Cost

Road Tax

Car Insurance

Parking, ERP & Petrol

Servicing

These costs will differ in terms of the type of car you’re driving, your usage, and your profile.

To make things easy, we’re going to use a brand new Toyota Corolla Altis as an example. SG CarMart lists the Toyota Corolla Altis with an Open Market Value (OMV) of S$19,430.

Note that the initial cost does not include the other charges associated with owning a car. This just shows how much you’re paying for the car.

Open Market Value (OMV) or Cost Of Car - S$19,421

As of this writing (Sept 2021), a Toyota Altis will cost you S$19,421, excluding the price of COE and other government costs. OMV refers to the total price paid out to a product that’s sold in Singapore. The OMW covers freight, insurance, and other charges that are incidental at the time of purchase. However, it’s worth noting that the costs might be different if you are thinking about buying a pre-owned car.

The cost of the car will play a huge role in the computation for how much you are going to pay for the various government fees listed below.

Interest Cost - S$1,904.14

Unless you are planning to pay the purchase price in full, interest costs will be charged based on the loan you acquire for your car.

Interest rates will vary depending on how much you borrow and the length of the loan duration. Simply put, the higher the amount and the longer the loan duration, the higher the interest cost will be.

Car financing options are limited to your car’s OMV. If the OMV is less than S$20,000, you can loan up to 70% of the purchase price. If you exceed S$20,000, you can loan up to 60% of the purchase price.

Using the Toyota Altis’ OMV, you can loan up to S$13,594.7. Assuming you get a 2% per annum interest rate and paid out for 7 years, your total interest paid out will be S$1942..1.

Caveat: car financing options will also consider the total amount you pay for your car, which will include the COE, ARF, and other costs.

Road Tax - S$7,420

At this time of writing, Road Tax for a Toyota Altis is $742 per year. Over a ten-year period, you’re looking at S$7,420.

Road Tax is determined by engine capacity on a per-annum basis. You can use this Road Tax Calculator provided by SGCarMart.

Car Insurance - S$7,077.66

Car insurance is mandatory in Singapore. How much you pay for insurance relies on several factors, including but not limited to:

The coverage that you want

The type of car you own

Your age

Your driving history

If this is your first time owning a car, the cheapest car insurance you can afford would be S$707.66 per annum according to MoneySmart.SG.

Pay that amount in ten years and you’re totaling to about S$7,077.66 over a ten-year period.

Petrol - S$15,660

People who are planning to purchase a car are more likely to use it regularly. Otherwise, what’s the point, right?

Regular usage translates to additional costs incurred for parking, petrol, and ERP.

These costs may go up and down depending on where you live, how much petrol you consume, and so on. Obviously, the more you use it, the higher these costs will be.

A Toyota Altis gets you 50 liters of petrol. As of this writing, you’re paying S$2.61 per liter. So, a full tank will cost you S$130.5. A Toyota Altis travels about 15km/l, so that’s roughly 750km total travelled on a full-tank.

If you travel 750km a month, you’re looking at S$1,566 per year, bringing you to S$15,660 for ten-years. But if you’re driving a lot and instead blow through 750km every two weeks, then you’re going through about S$3,000 worth of petrol monthly and about S$30,000 over a span of ten years.

Parking fees will vary depending on where you live and where you often go, so it will be difficult to estimate the total costs for parking fees alone. But we anticipate close to S$1,000 for a duration of ten-years.

What’s The Total Cost Of Our Toyota Altis (Over A 10-Year Period)?

To own a car in Singapore, you’re looking to spend S$51,482 in a span of ten years. These are based on estimates provided by numerous sites.

Note that we have not included the various government fees associated with owning a car.

Some caveats:

Petrol prices will go up and down, depending on the market. How far you travel on average on a monthly basis will dictate whether or not how much you’ll spend on petrol.

Government Fees Associated With Car Ownership

Okay, the big question that most first-time car owners have is: why does Singapore make it difficult to own or purchase a car? It’s because Singapore is a relatively small country. The number of cars allowed on their roads has to be controlled. This is why the government has actively decided to increase the price of car ownership by enforcing various fees and taxes.

Unlike other countries, owning a car in Singapore means you need to have deep pockets because you’re about to pay double the price of the car’s actual value for the government fees.

In Singapore, you are expected to pay for the following:

Certificate of Entitlement (COE)

Open Market Value (OMV)

Additional Registration Fee (ARF)

Excise Duty

Registration Fee

Vehicular Emissions Scheme (VES)

Other Charges (road tax, IU fee, car plate fee, dealer’s commission, and etc.)

Certificate Of Entitlement

Next to the OMV, the second biggest fee imposed on car ownership is the Certificate of Entitlement (COE). Without a COE, you can’t own or even drive a car you bought at the dealership.

The COE is required for people who want to register a new vehicle in Singapore. The COE represents your right to vehicle ownership and the right to use Singapore’s limited road space over the next ten years. But COE’s are not easily given or easily applied for. You need to bid for COE, which take place twice a month.

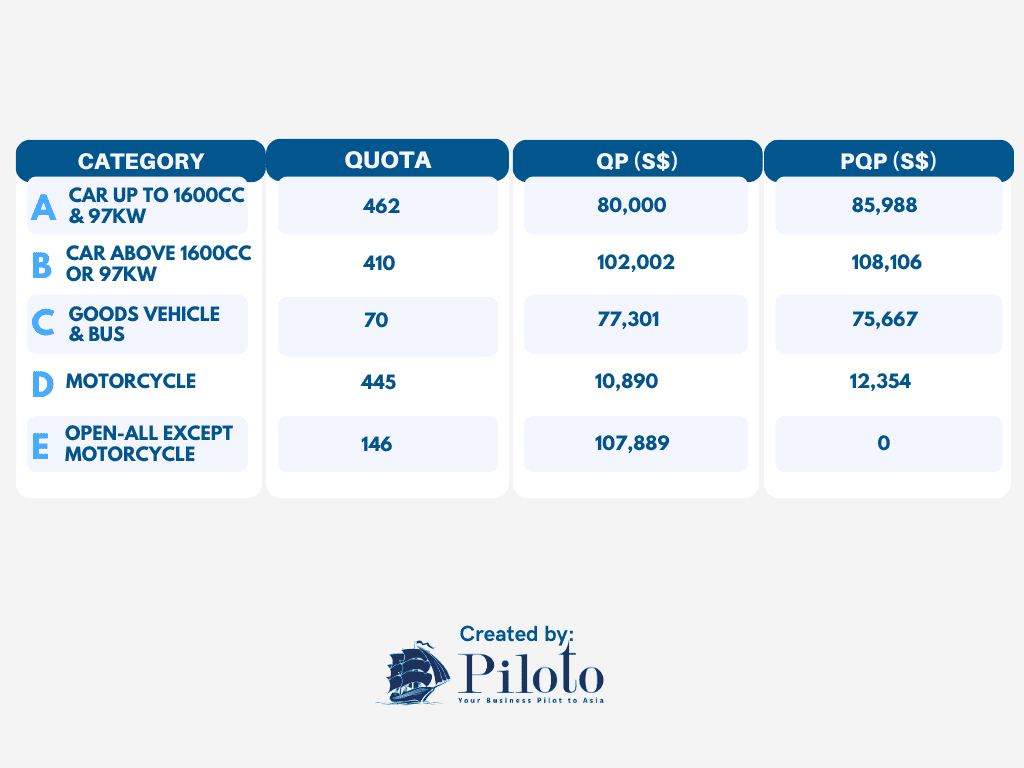

There are five categories of COE that are available for bidding:

Category A: Car up to 1,600cc and 97KW

Category B: Car above 1,600cc or 97KW

Category C: Goods vehicles and buses

Category D: Motorcycles

Category E: Open (all except for motorcycles)

Once the ten-year CEO period is up, you may choose to deregister your vehicle or revalidate your COE for another five to ten years by paying for the Prevailing Quota Premium (PQP), which is based on the 3-month moving average of the Quota Premium for the vehicle category you belong in.

Car owners who do not want to extend their COE will have their car deregistered as soon as their COE expires. The cost of the COE will be more than the actual price you pay for your car, which is why it’s so expensive to own even a simple sedan in Singapore.

Caveat: COE prices are determined based on supply and demand. If the supply of COE is low, but the demand is high, well expect to pay a lot of money for the bidding.

What Is The Current COE Price?

As of the latest Open Bidding Exercise in Jan 2023, here is the current COE Price:

There are two COE bidding exercises conducted by the Land Transport Authority (LTA) every month.

You can refer to the following sites for the bidding dates and COE prices:

Is It Cheaper To Bid For COE On Your Own?

A common practice in owning a car is to have your car dealers bid for you. This is why some car stores will already include the price of the COE in the total purchase price of the car.

But whether or not you can get it for cheaper is kind of iffy. For one, the price of the COE still remains the same because you’re paying based on the category. Like an auction, it just depends on how much people are willing to pay during the bidding exercise.

That’s why some refer to the current COE pricing that’s listed above as a way to gauge how much the next bidding will cost.

What Does Prevailing Quota Premium (PQP) Mean?

If you noticed the letters PQP in the current COE pricing, it refers to Prevailing Quota Premium. The pricing for a COE is referred to as QP, but how do these two differ from one another?

PQP refers to the amount that you need to pay in order to extend or renew the COE of a vehicle that’s already been registered. In some cases, PQP will have the same value as QP, but could be higher or lower as well.

For all vehicle categories, COE can be renewed for a period of five or ten years. If your COE was renewed for five years, it will no longer be eligible for renewal once the five years are up. This is the reason why car owners renew for ten years because they don’t have a limit for renewal. If you are planning on purchasing pre-owned cars, the cost of your COE will be based on PQP.

How Do You Bid For COE?

Land Transport Authority (LTA) announces how many COE’s are available for a bidding exercise along with the list of previous prices.

Caveat: previous COE prices do not influence the current COE prices for the current bidding.

COE Open Bidding Exercises take place every 1st and 3rd Monday of the month. It starts at 12 noon and ends on Wednesday the same week at 4:00PM.

In order to bid, you need to enter a Reserve Price (the cost you are willing to pay for a lot). Minimum bidding is S$1 and higher bids must be multiples of S$1. Revising your bid is allowed, but you need to pay administrative fees.

To bid, you need to have an active account with the following banks:

DBS /POSB (Individuals)

DBS (Companies and Motor traders)

Maybank (Companies and Motor traders)

UOB (Companies and Motor traders)

LTA Open Bidding Website

Go to the LTA Open Bidding Website and select Electronic COE Bidding and follow instructions. You’ll need to enter your reserve price, which is the price you’re willing to pay for a COE slot. If the bid is accepted, you’ll receive a 6-digit Acknowledgement Code that you can use to submit or revise your bid via the LTA Open Bidding Website.

When the bidding starts, you need to revise your bid to qualify for the available COE’s. While you are not privy to bids made by other people, you will always know what the lowest bid is. This bidding exercise will last for three days, so you’ll need to revise between now and Wednesday. If you want your bid to qualify, you need to beat the lowest bid for that day.

Once the bidding is closed, the bank will deduct the non-refundable administrative fee of $2 to $10 from your account. If you were successful in your bid, the bank will also deduct the bid deposit:

You’ll also be deducted the administrative fees that were charged to you during the bidding/revising period. The administrative fees are non-refundable.

Once that’s done and your bid was accepted, CONGRATULATIONS!

What Happens After Ten Years?

One of the most difficult things to understand as a car owner in Singapore is what happens when your COE expires.

There are only two answers: either you deregister your car and get your money back, or extend your COE.

If you choose to deregister your car, you’ll get a PARF rebate. PARF stands for Preferential Additional Registration Fee. This is a % of the ARF that you’ve already paid. You get 50% of the ARF, so assuming that the ARF for your car is S$19,430, you are eligible for S$9,715 in rebates. You might also get some more cash back for the car body, but that’s only a few hundred dollars depending on the brand and make.

Deregistering your car before the ten-year mark will get you more ARF rebate and a COE Rebate too.

If you scrap your car in the 9th year and your COE was S$46,890, you get S$4,689 back.

What If You Extend Your COE?

Extending your COE for five more years won’t allow you to renew it once it expires, but if you renew for ten years, you can continue to extend after the first extension.

The downside to renewing your COE is that you don’t get any ARF or PARF. Now you know why people are just eager to buy a newer car as opposed to buying a pre-owned one.

Registration Fee

You need to pay a Registration Fee of S$220 to the Land Transport Authority (LTA) for registering a new car.

Additional Registration Fee

Additional Registration FEE (ARF) is a tax imposed on registering a new car. The tax is based on the percentage of a vehicle’s OMV. These are the values for the ARF rates.

Vehicular Emissions Scheme (VES) rebates are subtracted from the rates above.

Computing for ARF is cumulative. Again, we’re going with the Toyota Altis. Here’s the computation:

Its OMV is S$19,421. Because it’s less than S$20,000 you get charged 100% of the OMV, so your ARF is S$19,421.

But if your car is higher than S$20,000, you get charged 100% of OMV plus the next tier, which is 140% of Incremental OMV.

So if your car is S$21,000, here’s how your ARF is determined:

Tier 1 - 100% of OMV on first S$20,000: S$25,000

Tier 2 - 140% of OMV on next S$1,000: S$1,400

Your total ARF is S$26,400. Imagine how much you’re paying if your car is priced higher than S$50,000.

Excise Duty

Excise Duty is a tax imposed by the Singapore Customs, which is 20% of the vehicle’s OMV.

For your Toyota Altis, you’re looking at S$3,886 for the Excise Duty. This is non-negotiable and cannot be discounted.

Vehicular Emissions Scheme (VES) Surcharge

Singapore encourages aspiring car owners to go for more environmentally-friendly cars. This is made possible with the Vehicular Emissions Scheme (VES) Surcharge. Your model is tested based on emission levels of five air pollutants, namely:

Hydrocarbons

Carbon monoxides

Nitrogen oxides

Carbon dioxides

Other particulate matter

Your vehicle is assigned a band based on the worst pollutant. Vehicles that generate less pollutants will qualify for a rebate, which is applied to the ARF.

Your dealers will have this information readily available to you. In this case, a Toyota Altis will have a S$0 surcharge and will fall between A1 and A2 Bands based on dealership information. You’ll enjoy a rebate of S$10,000 and up to S$20,000, which is applied to your ARF.

If you do get that S$20,000 rebate, you’ll only need to pay S$5,000 for the ARF because car owners are required to pay that minimum amount. You can refer to the table below for the VES Rebate/Surcharge:

In 2024, new Vehicular Emissions Scheme (VES) regulations were enacted in Singapore. These revised standards are designed to encourage further the adoption of cleaner and more environmentally friendly vehicles.

The VES system has been enhanced with increased rebates and higher surcharges, now based on a vehicle's carbon dioxide (CO2) emissions. However, there will be no change to the VES surcharge until December 31, 2025.

For cars falling under the A1 band, the VES rebate remains at S$25,000. This applies to cars with zero tailpipe emissions, such as electric vehicles (EVs). This is part of the government's sustained efforts to encourage vehicle electrification.

It's worth noting that the previous VES were extended to December 31, 2025, with tighter pollutant thresholds introduced in 2024.

These changes will likely impact the cost of owning a car in Singapore and may influence buyers' decisions when choosing a vehicle.

So How Much Does It Cost to Own a Car?

Author note: OMV is based on average pricing listed on car dealership websites in Singapore as of this writing (Sept 2021). Certain examples were used for computations carried out in this article and should only be used for gauging estimates.

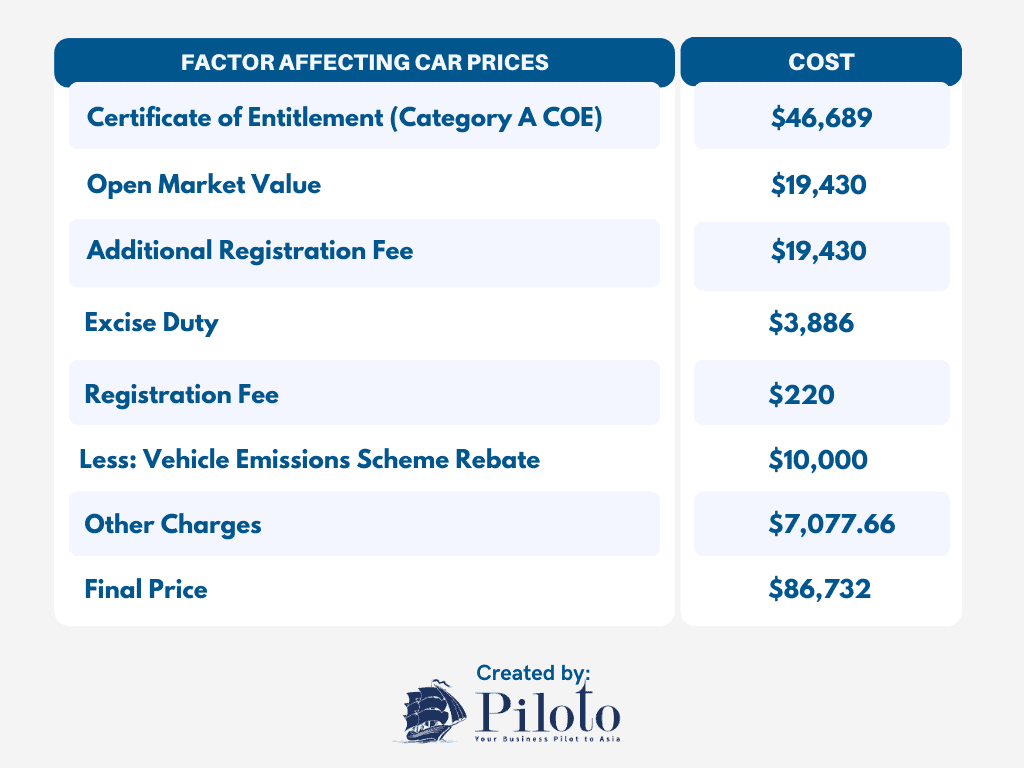

Okay, now that we have the fees and costs associated with buying a car, let’s look at how much you’ll actually pay for a Toyota Altis in government fees:

So, in order to buy a Toyota Corolla Altis, you need to shell out a whopping S$86,372! That’s just for government fees.

You also have the expenses incurred for owning the car, which we totalled above to S$51,482 in a span of ten years. That’s how expensive it is to own a car in Singapore.

That’s roughly S$138,214 out of your bank account from the time you buy your car and up to the time your COE expires.

Closing

To say that owning a car in Singapore is a luxury is an understatement. The country’s push for sustainable development and environmentally-friendly infrastructure is made clear by restricting the use of cars in their limited road space.

This is one of the reasons why the public transportation infrastructure in Singapore is considered to be one of the best in the world. Singapore wants people to take advantage of the metro and bus transit system to get around the country. After all, Singapore is not really that big.

So, you still want to buy a car?

Frequently Asked Questions

-

The accounting and tax implications of owning a car in Singapore vary depending on the type of car you own and how you use it. For example, if you own a car that you use for business purposes, you will need to keep track of your business mileage and expenses. You can then claim these expenses as a deduction against your business income. Singapore's accounting and tax laws can be complex, so it is important to consult with an accountant or tax advisor to ensure that you are complying with all the relevant regulations.